All Categories

Featured

Table of Contents

These would certify as certified financiers under different standards in the meaning. The SEC has a set of questions it sends on a regular basis to figure out the status yet I was unable to find if these outcomes are released openly. Quotes of the variety of investors that are recognized are normally produced by market study tasks or firms.

There is no limitation to exactly how several bucks an investor can invest in a Guideline D 506(c) offering. This is normally to protect against any solitary financier holding a managing passion in the investment.

Policy 506(c) enables business to carry out basic solicitation for their investments gave that all capitalists are recognized investors at the time they pay into the financial investment. You can verify your certified financier status to the company offering you safety and securities by offering a letter from your accountant, tax filing files, pay stubs, financial institution statements, economic declarations, or any other certification that proves you meet the required needs.

It is the task of the investment company that is offering you the protections to identify your standing. They will certainly let you recognize what they need, to verify sufficiently to themselves that you satisfy the requirements. Recognized financiers have access to possibly higher-yield investments yet this does not instantly guarantee them a greater return.

Most Affordable Accredited Investor Wealth-building Opportunities

These financial investment types are thought about risky, but HNWIs spend in them due to the fact that they do provide such constant gains. The returns from alternative investments are commonly much higher than for Exchange Traded Funds (ETFs) or Mutual Funds.

Certified capitalists have access to a much bigger array of financial investment possibilities to make cash. Alternative investments give some of the most versatile kinds of investment approaches around due to the fact that they do not require to adhere to policies so purely.

Any individual that does not fulfill the accredited investor requirements is considered an unaccredited investor, or a non-accredited financier. That implies the individual does not have either the total assets or the called for expertise to be revealed to the prospective threat readily available in high-yield financial investments. The crowdfunding version is a wonderful opportunity for unaccredited capitalists since it has produced numerous possibilities for people that do not have the capital needed to buy bigger tasks.

Accredited Investor Financial Growth Opportunities

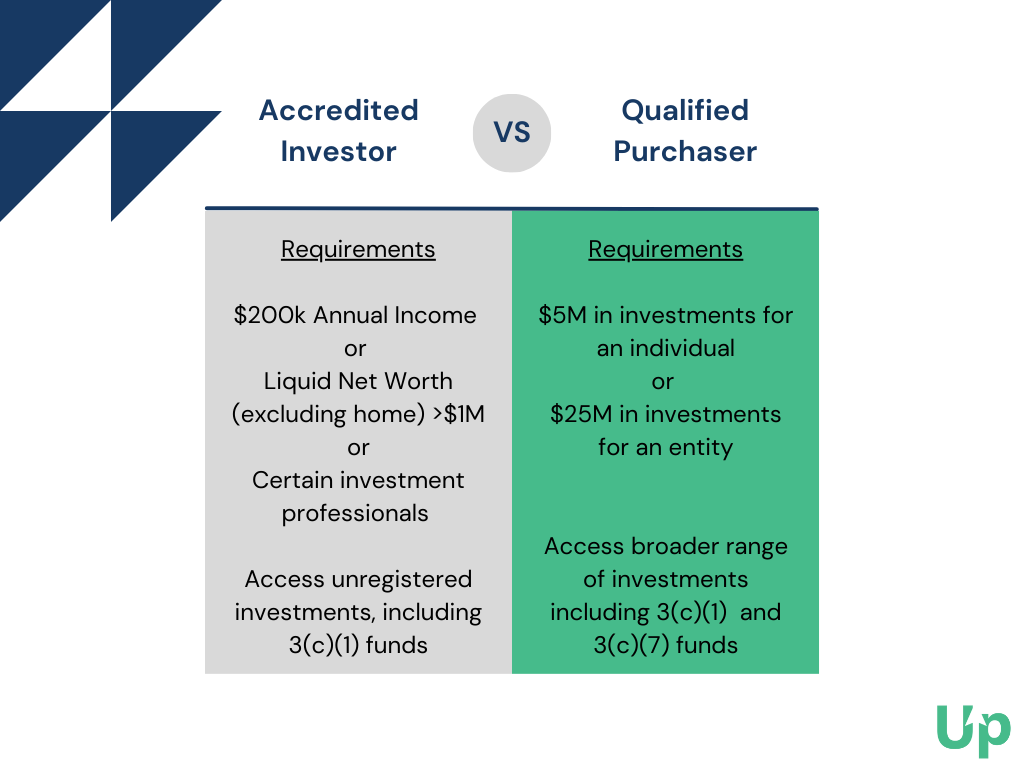

A Qualified Buyer is a person with at the very least $5 million well worth of investments. Every qualified purchaser is immediately also an accredited investor however every recognized capitalist is not necessarily a qualified buyer. An accredited capitalist could have a web worth of over $5 million yet not have all of it connected up in financial investments.

Financial Preparation and Evaluation (FP&A) is the practice of planning, budgeting, and assessing an individual or business's financial status to identify the best possible means onward for their riches. FP&A is a particularly vital task for recognized investors to make sure that their wealth does not cheapen as a result of rising cost of living.

Not all advanced investors are recognized. In particular offerings, advanced capitalists are allowed to get involved, such as in 506(b) offerings, nevertheless, Wealthward Funding deals exclusively in 506(c) offerings so all our investors need to be recognized.

First-Class Accredited Investor Opportunities

Some financial investment chances can be greatly controlled to safeguard capitalists and the issuers of securities. The United State Securities and Exchange Payment (SEC) doesn't allow all investors to make every financial investment. Specific investments are restricted only to accredited capitalists, which are people or entities that meet a checklist of stringent qualifications.

Understanding how to come to be a certified capitalist can assist you determine whether you certify. The meaning of an approved investor is a legal entity or an individual that is legally enabled to invest in financial investments that are not registered with the SEC. The SEC recognized investor interpretation depends on Guideline 501 of Regulation D of the Securities Act of 1933.

Venture Capital For Accredited Investors

Offerings signed up with the SEC should openly divulge information to financiers and fulfill particular demands from the SEC for guarding investments. These financial investment possibilities include openly traded bonds, supplies, common funds, and openly traded property investment company (REITs). However, recognized financiers need to have the economic expertise and experience to spend in offerings that do not offer these defenses.

The needs for qualifying as an approved investor are in area to guarantee these financiers have the wherewithal to handle their funds and shield themselves from loss. The term certified capitalist is also made use of to explain investors who have the financial capability to take in losses. The SEC's requirements for accredited capitalists are different for specific and institutional financiers.

The capitalist needs to reasonably anticipate to keep the very same income degree in the current year. Their internet well worth can not consist of the value of their main house.

Exceptional Accredited Investor Real Estate Investment Networks for Accredited Wealth Opportunities

Policy 501 additionally offers requirements for firms, companies, counts on, and other entities to qualify as accredited financiers. An entity can certify as a certified investor when it meets one of the following standards: The organization or exclusive business certifies as an approved capitalist when it has greater than $5 million in properties.

An entity may certify as a certified investor if it has investments going beyond $5 million, was not created to obtain protections, and meets none of the various other needs for entities. If all of the entity's proprietors are accredited financiers, the entity can function as an approved financier. The complete checklist of criteria likewise includes specific firm kinds no matter of total properties or investments, including: BanksInsurance companiesInvestment companiesCertain fringe benefit plansBusiness development business The recognized financier meaning makes certain capitalists have the funds and experience to sensibly protect themselves from loss.

Firms can offer safeties specifically within one state without federal enrollment. Business can sell securities to non-accredited financiers using crowdfunding platforms under the JOBS Act.

State, government, and community governments can offer securities without registration. The certified capitalist category safeguards investors. Regulators intend to advertise risk-free and educated financial investment in endeavors with varying levels of danger. They additionally want to secure much less skilled capitalists that don't have the knowledge to understand an investment's threats or the cushion to take in losses.

Latest Posts

Tax Lien Investing Online

Government Tax Foreclosures

Tax Delinquent Property For Sale