All Categories

Featured

Table of Contents

It's essential to remember that SEC guidelines for recognized financiers are created to shield financiers. Without oversight from financial regulatory authorities, the SEC simply can not evaluate the threat and reward of these investments, so they can not provide details to educate the ordinary capitalist.

The concept is that capitalists who gain sufficient income or have sufficient riches have the ability to take in the danger far better than investors with lower revenue or less wide range. accredited investor alternative asset investments. As an approved capitalist, you are expected to finish your very own due persistance prior to adding any kind of asset to your financial investment portfolio. As long as you satisfy among the adhering to 4 demands, you qualify as a certified financier: You have made $200,000 or even more in gross earnings as a private, each year, for the previous 2 years

You and your partner have had a combined gross earnings of $300,000 or more, every year, for the previous two years. And you anticipate this degree of earnings to continue. You have an internet well worth of $1 million or even more, omitting the value of your main residence. This suggests that all your assets minus all your debts (omitting the home you live in) total over $1 million.

Optimized Investment Platforms For Accredited Investors for Accredited Investment Results

Or all equity proprietors in the company certify as certified capitalists. Being an accredited investor opens up doors to investment opportunities that you can not access or else.

Coming to be a certified capitalist is merely a matter of proving that you satisfy the SEC's needs. To validate your revenue, you can offer documents like: Tax return for the previous 2 years, Pay stubs for the past two years, or W2s for the past two years. To validate your total assets, you can give your account statements for all your assets and responsibilities, consisting of: Cost savings and inspecting accounts, Financial investment accounts, Impressive finances, And property holdings.

Trusted Exclusive Investment Platforms For Accredited Investors for Secured Investments

You can have your lawyer or certified public accountant draft a verification letter, verifying that they have examined your financials and that you meet the demands for an approved capitalist. It may be more affordable to utilize a solution particularly developed to verify recognized capitalist standings, such as EarlyIQ or .

For instance, if you join the actual estate investment company, Gatsby Investment, your certified investor application will be refined via VerifyInvestor.com at no charge to you. The terms angel investors, innovative financiers, and accredited financiers are often used reciprocally, yet there are subtle differences. Angel capitalists offer venture capital for startups and local business in exchange for ownership equity in business.

Generally, anyone that is approved is assumed to be an innovative capitalist. People and organization entities that maintain high incomes or big riches are assumed to have affordable knowledge of finance, certifying as advanced. Yes, international investors can come to be recognized by American monetary standards. The income/net worth requirements continue to be the very same for foreign investors.

Here are the best investment opportunities for accredited financiers in actual estate.

Personalized Accredited Investor Syndication Deals

Some crowdfunded genuine estate financial investments don't call for accreditation, yet the jobs with the biggest prospective rewards are normally scheduled for accredited financiers. The difference in between projects that accept non-accredited capitalists and those that just approve recognized investors typically comes down to the minimum financial investment quantity. The SEC presently limits non-accredited capitalists, that earn less than $107,000 annually) to $2,200 (or 5% of your yearly revenue or web worth, whichever is less, if that amount is more than $2,200) of financial investment resources annually.

It is extremely comparable to genuine estate crowdfunding; the process is essentially the same, and it comes with all the same benefits as crowdfunding. Actual estate submission supplies a steady LLC or Statutory Trust ownership version, with all financiers serving as participants of the entity that owns the underlying real estate, and an organization that facilitates the project.

a business that buys income-generating realty and shares the rental earnings from the buildings with capitalists in the kind of dividends. REITs can be openly traded, in which instance they are controlled and readily available to non-accredited financiers. Or they can be personal, in which case you would need to be approved to invest.

Groundbreaking Accredited Investor Wealth-building Opportunities

Management costs for a personal REIT can be 1-2% of your overall equity each year Acquisition fees for new purchases can come to 1-2% of the acquisition price. And you may have performance-based charges of 20-30% of the exclusive fund's profits.

While REITs focus on tenant-occupied residential properties with steady rental income, private equity genuine estate companies focus on real estate advancement. These firms often establish a plot of raw land right into an income-generating residential or commercial property like an apartment complicated or retail purchasing. Just like personal REITs, investors secretive equity ventures usually need to be recognized.

The SEC's definition of recognized financiers is created to determine people and entities deemed financially innovative and efficient in assessing and joining certain sorts of exclusive financial investments that might not be readily available to the general public. Relevance of Accredited Investor Condition: Conclusion: Finally, being a certified financier carries considerable value worldwide of financing and financial investments.

High-Performance Accredited Investor Opportunities with Maximum Gains

By meeting the requirements for recognized financier status, individuals demonstrate their financial refinement and get to a world of financial investment possibilities that have the prospective to create substantial returns and add to long-term financial success (accredited investor investment opportunities). Whether it's buying startups, real estate ventures, private equity funds, or various other alternative properties, approved financiers have the advantage of discovering a varied array of financial investment choices and developing wealth by themselves terms

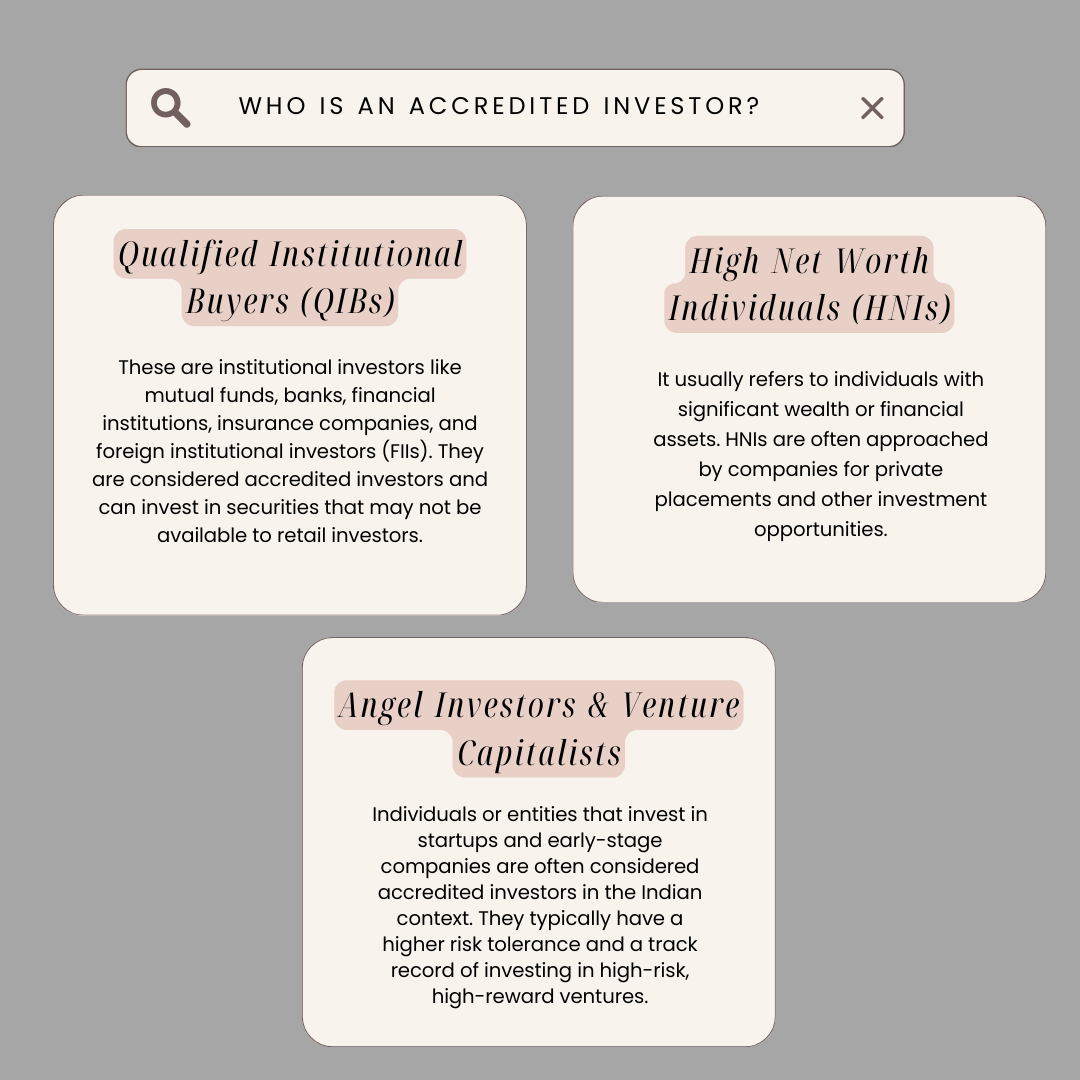

Recognized financiers include high-net-worth people, financial institutions, insurance firms, brokers, and counts on. Certified financiers are specified by the SEC as qualified to invest in facility or innovative types of safety and securities that are not very closely managed. Specific standards have to be fulfilled, such as having an ordinary annual revenue over $200,000 ($300,000 with a spouse or domestic companion) or functioning in the monetary market.

Unregistered protections are naturally riskier since they do not have the normal disclosure requirements that come with SEC registration., and different bargains entailing complicated and higher-risk investments and instruments. A company that is seeking to increase a round of financing might make a decision to directly approach accredited investors.

Latest Posts

Tax Lien Investing Online

Government Tax Foreclosures

Tax Delinquent Property For Sale